Stress-Free Tax Solutions You Can Trust

From individuals to business owners, Empyre Tax Pros makes filing simple, accurate, and stress-free — so you can maximize your refund and minimize your stress.

About

Empyre Tax pros

Empyre Tax Pros delivers straightforward, dependable, and stress-free tax solutions for individuals and businesses. With tax filings handled by Makenzie Dayton, we simplify the process, eliminate costly mistakes, and help you keep more of your hard-earned money. We don’t just prepare taxes — we build lasting relationships based on integrity, professionalism, and results.

Our goal is simple: to make your tax experience smooth, stress-free, and financially rewarding. With years of experience and a client-first approach, we pride ourselves on delivering accurate filings, personalized strategies, and peace of mind during tax season.

Whether you’re an individual looking to maximize your refund or a business owner in need of expert support, we’re here to guide you every step of the way.

Our Tax Services

Solutions Tailored to Your Needs

Individual Tax Preparation

Maximize your refund and file with confidence.

Small Business Tax Services

From deductions to compliance, we’ve got you covered.

IRS Problem Resolution

Guidance and support for back taxes, notices, or audits.

Prior Year & Late Filings

Get caught up quickly and avoid penalties.

Self-Employed & Contractor Support

Simplified solutions for 1099s and freelancers.

Tax Planning & Strategy

Proactive advice to minimize your tax liability and maximize savings.

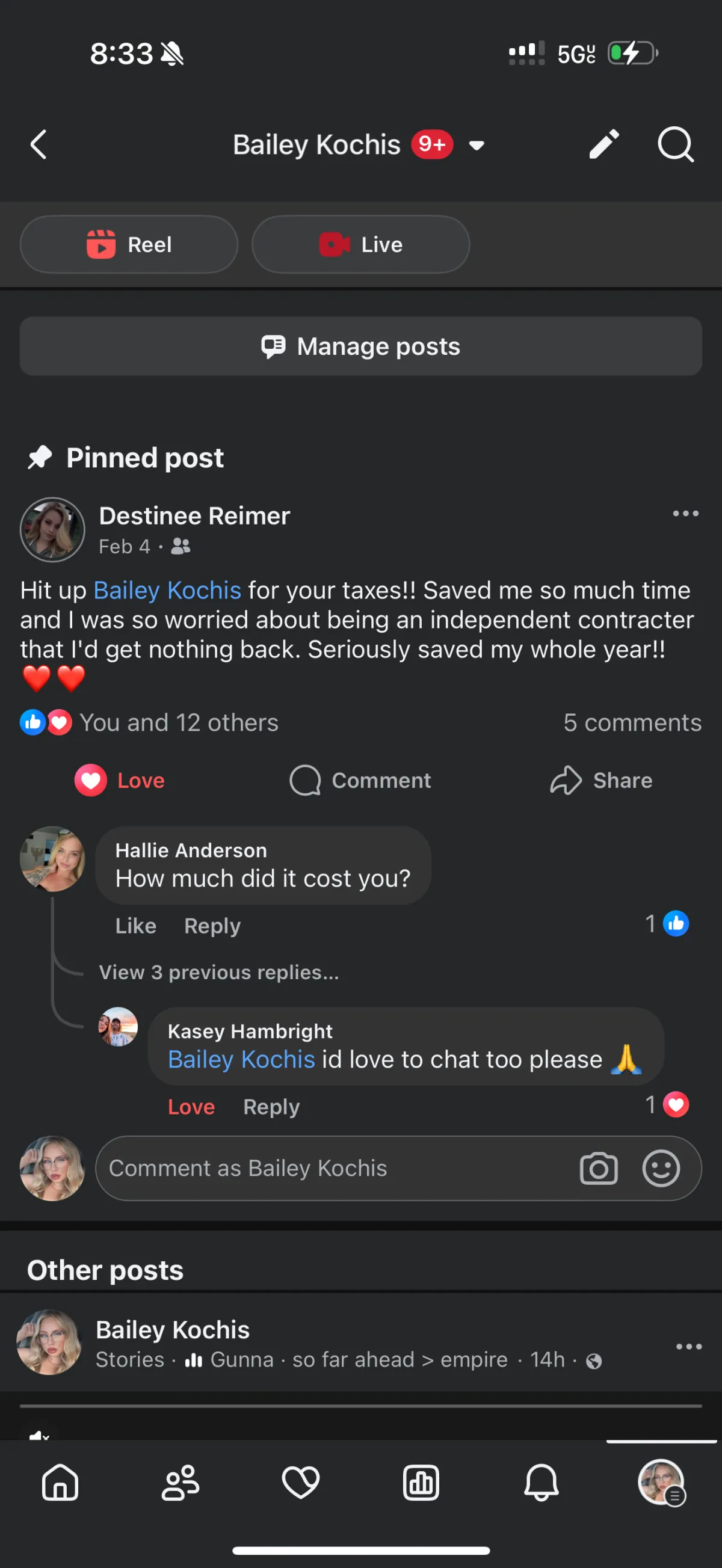

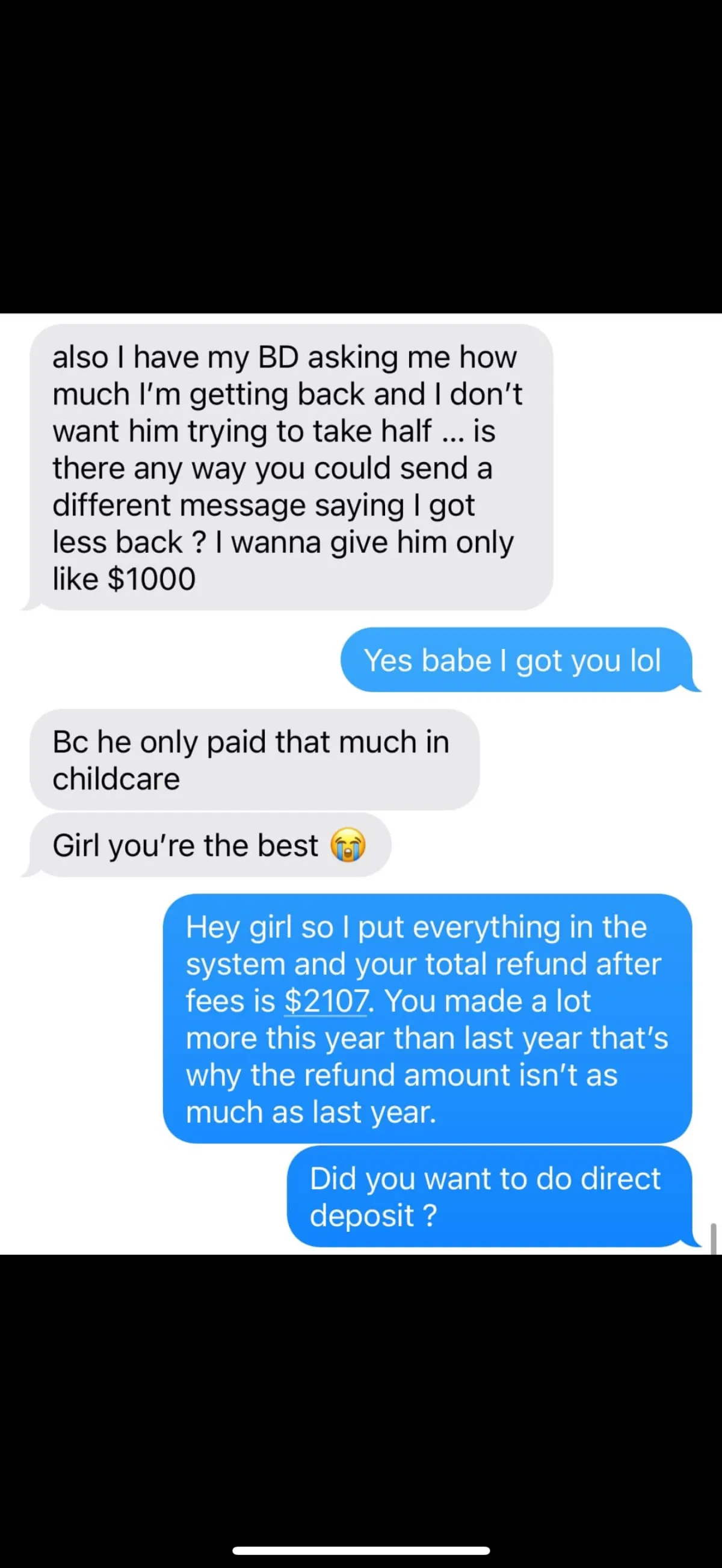

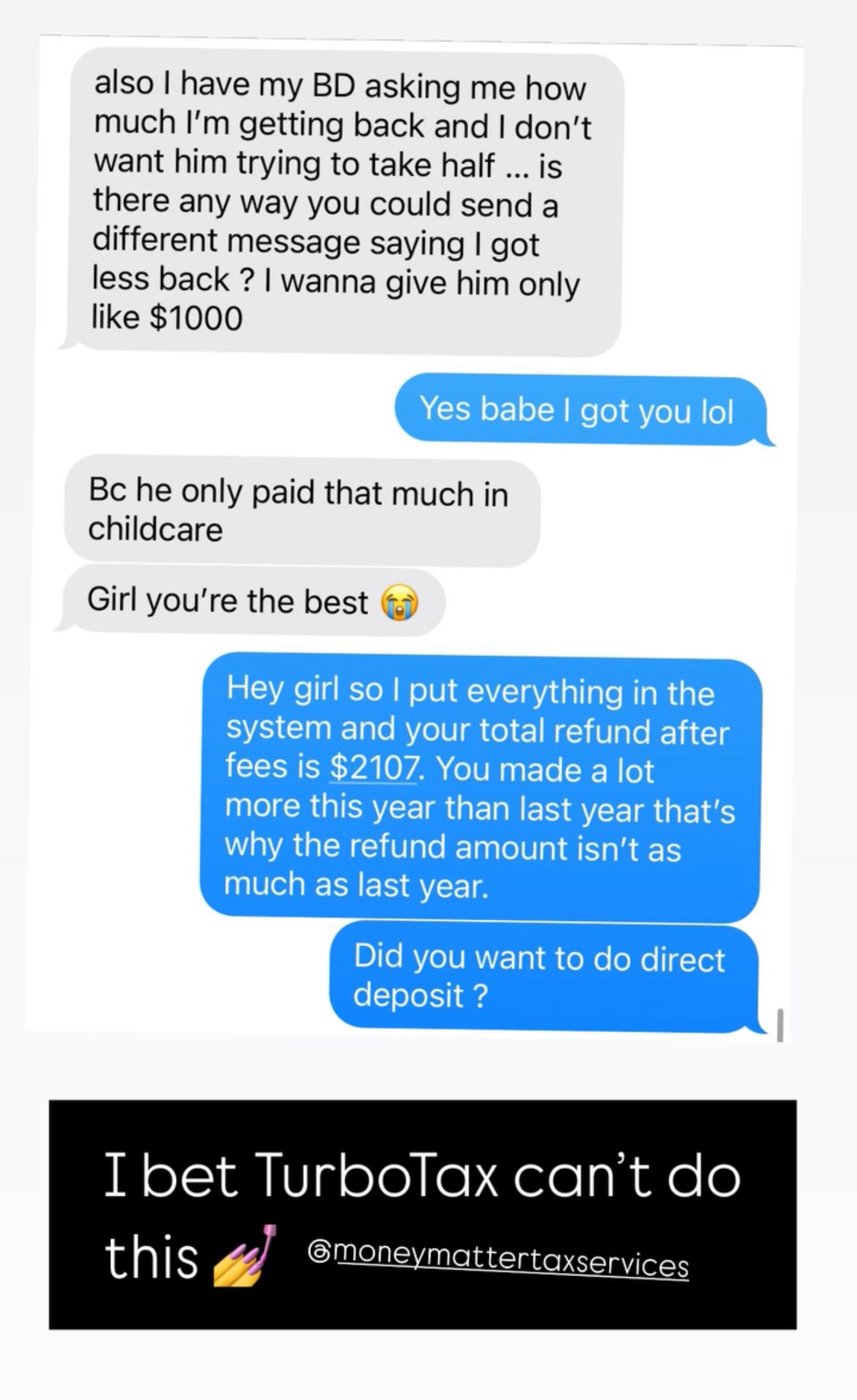

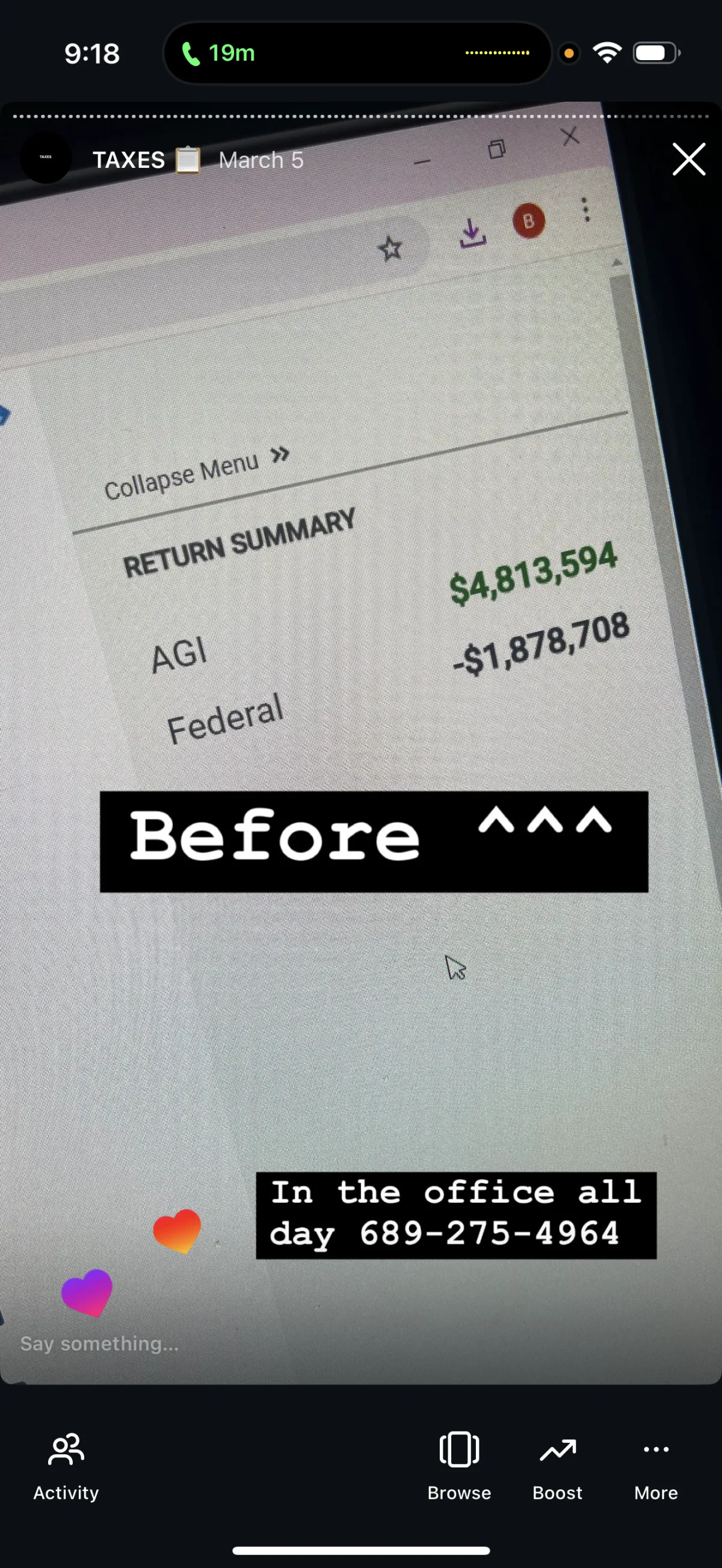

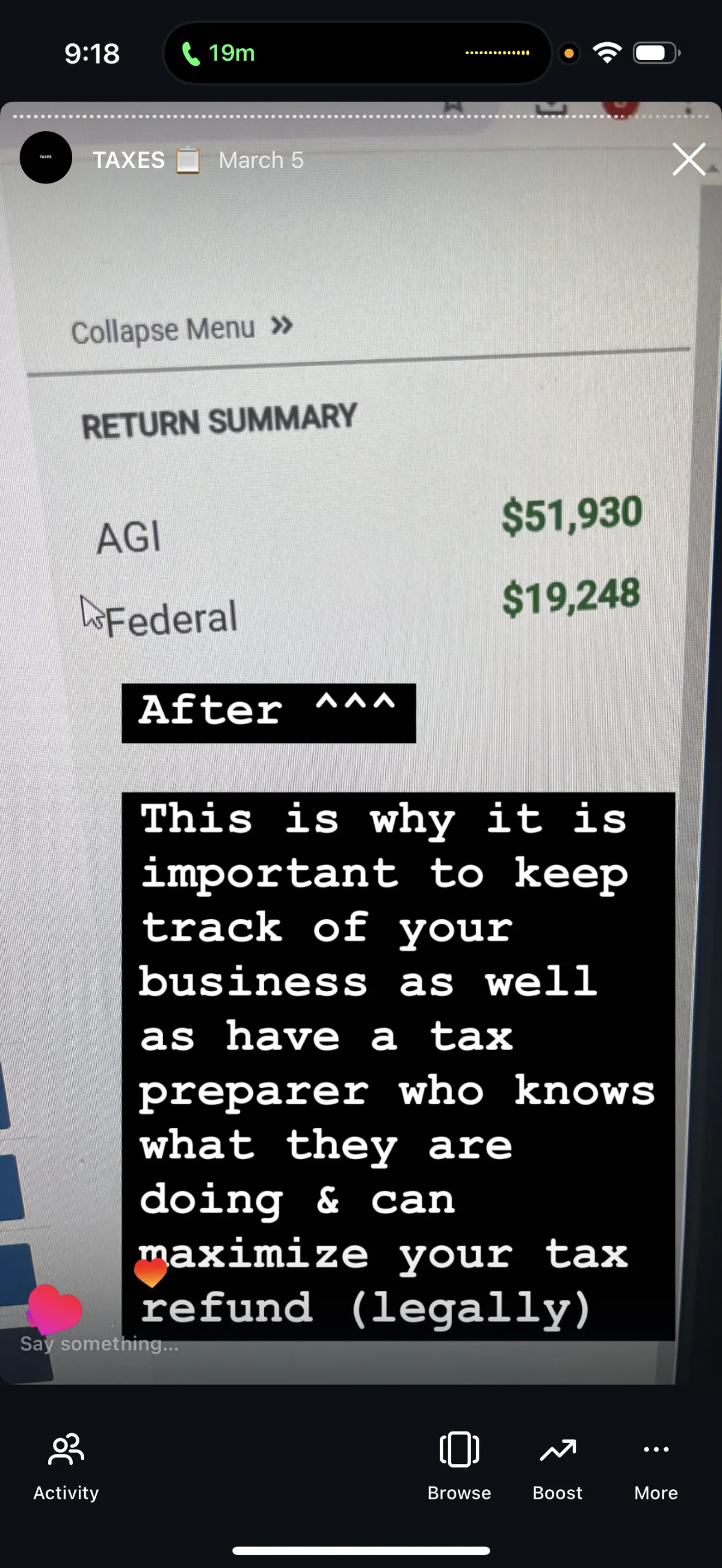

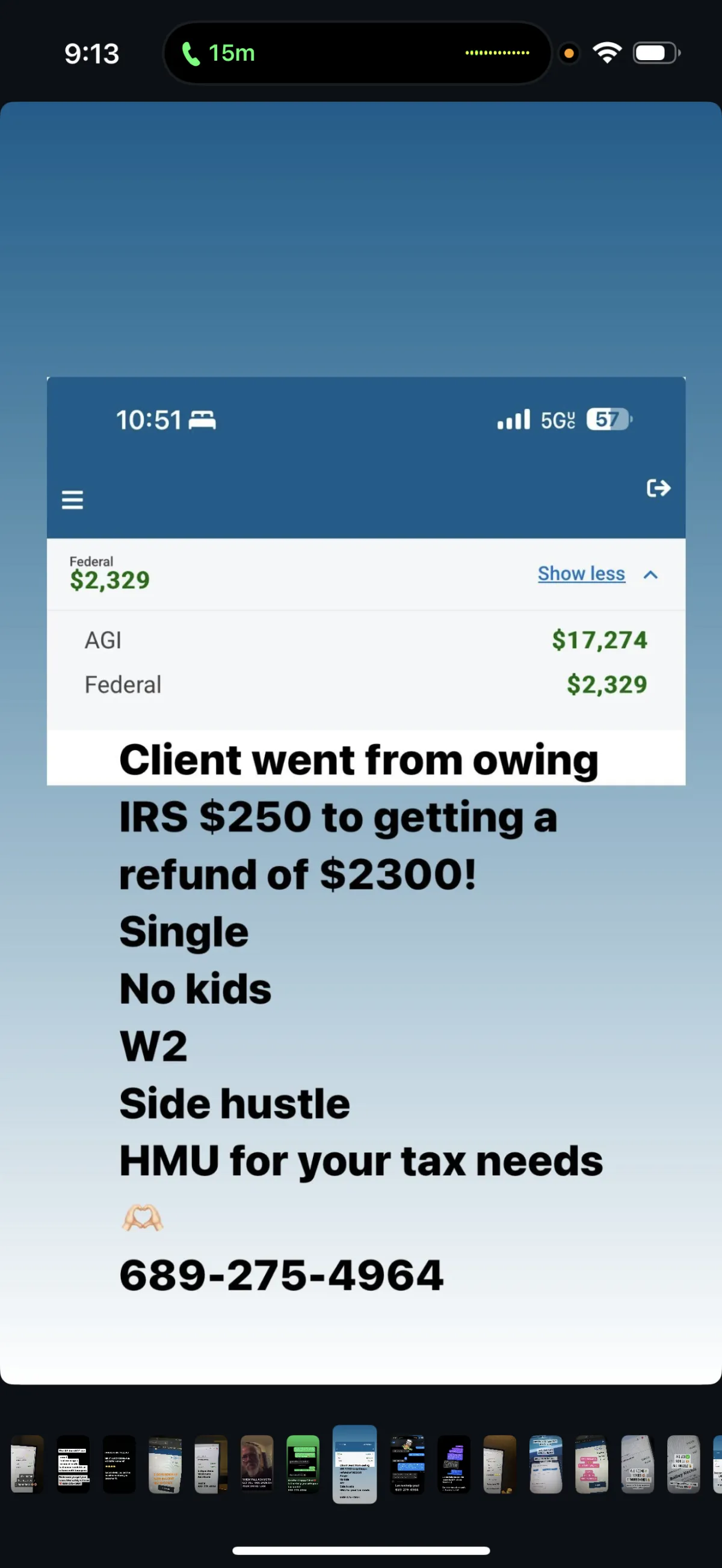

See Why Clients Trust Makenzie Dayton With Their Taxes

Taxes Don’t Wait

And Neither Should You

Secure your free consultation today and let Makenzie Dayton handle the rest.

Frequently Asked Questions

How soon can I get my refund?

Refund times vary, but we’ll help you file quickly and correctly.

Do you work with both individuals and businesses?

Yes, we serve both personal tax clients and business owners nationwide.

Can you help if I owe the IRS money?

Yes — we can assist with back taxes and help you create a plan.

What documents should I bring to my consultation?

W-2s, 1099s, receipts, and any IRS letters you’ve received.

Do you handle past years or late tax filings?

Absolutely, we help clients get caught up on prior year filings.

NOTE FACEBOOK: This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

INCOME DISCLAIMER : Although we make every effort to accurately represent the services and/or products presented on this website, Makenzie Dayton makes no assurance, representation or promise regarding future earnings or income, or that you will make any specific amount of money, or any money at all, or that you will not lose money. Earnings or income statements, or examples of earnings or income, represent estimates of what you may earn; however, there is no promise or guarantee that you may experience the same level of earnings or income. There is no assurance that any prior success or past results regarding earnings or income may be an indication of your future success or results.

MULTI-LEVEL MARKETING: This program is NOT a multi-level or network marketing firm, Any individual, without any payment by participants, can become a part of the referral program by creating a free account online.

BUSINESS OPPORTUNITY: This program, and associated training are NOT considered an income or business opportunity according to the Business Opportunity Rule § 437.1m;. This states “that advertising and general advice about business development and training shall not be considered as ‘providing locations, outlets, accounts, or customers.’”.